National Insurance (NI) is paid by both employers and employees. By paying NI contributions employees qualify for certain benefits such as the State pension and maternity leave.

Employees pay Class 1 NI if they’re:

- 16 or over

- earning above £155 a week

- Under the state retirement age

Employers pay Class 1 NI for their employees if the employee is:

- 21 or over

- Earning above £156 a week

- Working beyond state retirement age

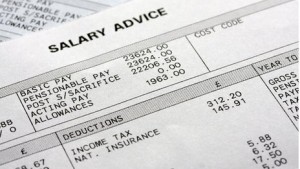

Contributions are made through PAYE and deducted from an employee’s pay. The amount deducted depends on earnings and NI Category letter

Employers also pay Class 1A and 1B NI once a year on expenses and benefits they give to their employees.

Employers can get £3,000 off their NI bill with the Employment Allowance. The allowance will reduce your employers’ Class 1 National Insurance each time you run your payroll until the £3,000 has gone or the tax year ends (whichever is sooner). Directors who are the only paid employees can no longer take advantage of Employment Allowance.