You must give your staff a payslip every time they get paid, whether that’s every two weeks or every month. This will show you how much they’ve been paid and how much tax and National Insurance have been taken away. The payslip can be paper or electronic. It doesn’t matter as long as your employees get one.

You must give your staff a payslip every time they get paid, whether that’s every two weeks or every month. This will show you how much they’ve been paid and how much tax and National Insurance have been taken away. The payslip can be paper or electronic. It doesn’t matter as long as your employees get one.

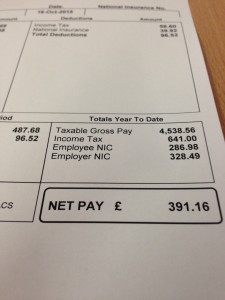

Your payslip must show:

- Gross pay: the amount of pay before tax National Insurance has been taken away

- Variable deductions: those which change each time you get paid ie tax and National Insurance, if hours vary, sick pay or maternity pay.

- The total amount of any fixed deductions: Deductions which don’t change from payday to payday, such as subscriptions.

- The total amount of take-home pay after deductions

You can choose to include the following information:

- National Insurance number

- Tax code

- Pay rate (either annual or hourly)

- Breakdown of additional payments like overtime, tips or bonuses, which must in any case be included in your gross pay figure

- Holiday entitlement if holiday is accrued.

Here’s a handy tool from the Chartered Institute of Payroll Professionals to help you understand what’s on a payslip.

The Money Advice Service also has guidance on how to decode a payslip.